Politics

Kinnock Wants the Super-Rich to Pay Up in Bold Wealth Tax Move That Could Rake in Billions

Labour should hit the ultra-wealthy with a 2% tax on fortunes over £10 million, says former party leader Neil Kinnock, who reckons the move could hand Sir Keir Starmer’s Government an extra £11 billion a year.

Speaking on Sunday Morning with Trevor Phillips on Sky News, Kinnock reflected on the Government’s first year in office and didn’t hold back. He said it looks like Labour has been “bogged down by their own imposed limitations” and urged the party to be bolder.

He believes the public is ready for a fairer system and said, “There are things the party could do that would commend themselves to the great majority of the general public,” pointing specifically to “asset taxes”, reported the Express.

Kinnock, who led Labour between 1983 and 1992, argued that targeting just the wealthiest would not only generate serious cash for public services but also show that Labour stands for fairness. “By going for an imposition of 2% on asset values above £10 million, say, which is a very big fortune, the Government would be in a position to collect £10 billion or £11 billion,” he explained.

To ease concerns about ordinary people being dragged into the mix, he made it clear that people’s homes wouldn’t be touched unless they were worth well beyond £7 million. “That’s not going to pay all the bills,” he admitted, “but that kind of levy secures revenue and tells the country we are the government of equity.”

Pressed on whether Labour should now rethink the strict rules it set on spending and borrowing, Kinnock hinted that a more flexible approach could be on the cards. He didn’t dismiss the idea that Starmer’s cabinet might be ready to reconsider those self-imposed limits.

The idea of taxing the rich is gaining traction in Labour circles, especially after the party’s recent welfare policy U-turn. Rachael Maskell, who led a group of rebel MPs that forced the change, has also thrown her support behind a wealth tax to plug the funding gap.

She argued that a combination of higher capital gains tax and similar measures could rake in up to £24 billion a year. That would more than cover the estimated £5 billion cost of ditching the original welfare plan.

Maskell’s intervention comes just days after her backbench revolt forced Starmer to scrap controversial reforms and rethink the Government’s approach to social support. Now she’s calling on the party to match that policy shift with a bold tax stance that squarely targets those who can most afford it.

With pressure building from within and calls for action on inequality getting louder, the question for Starmer is whether he’ll stick to his cautious fiscal rules or take a risk on something bolder. As Kinnock and others see it, taxing vast personal fortunes could be both popular and practical – and maybe just the kind of move Labour needs to prove it’s serious about real change.

Don’t Miss These:

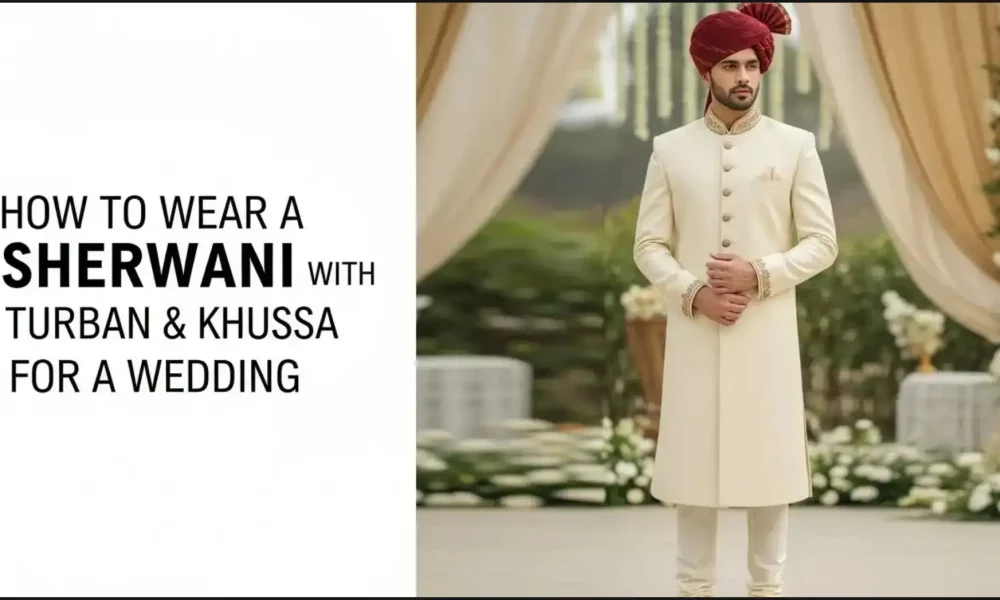

- How to Wear a Sherwani with Turban & Khussa for a Wedding

- “Happy Christmas to the Welsh Guards!” as Prince William shrugs off Prince Harry’s latest UK push

- Wedding Sherwani for Groom: Ideas for Nikkah, Baraat, & Special Events

- Crockett’s Bold Senate Campaign Video Draws Mixed Reactions Over Trump Attacks

- Ted Cruz Warns Trump’s Drone Plan Could Derail Major Defense Bill