Politics

How to Get a Refund for Student Loan If You Paid During Pandemic: Details

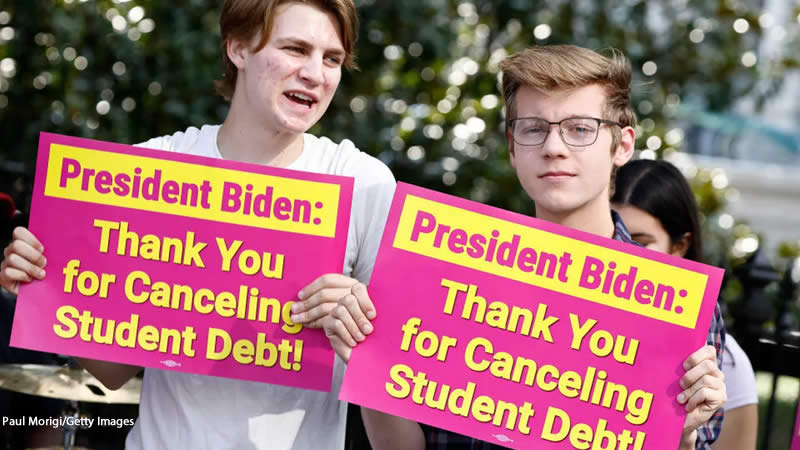

When President Joe Biden announced a plan to forgive student loan debt, many borrowers who had continued to make payments during the pandemic questioned whether they had made the right decision.

Borrowers who paid down their debts during the pandemic freeze, which began in March 2020, can get a refund, and then apply for forgiveness, but the process hasn’t always been clear.

Who is eligible for a refund?

According to the Department of Education, borrowers who have eligible federal student loans and have made voluntary payments since March 13, 2020, are eligible for a refund.

That refund will be automatic for some people. If your payments brought your loan balance below the maximum debt relief amount of $10,000 for all borrowers and $20,000 for Pell Grant recipients, you can get a refund without applying. Borrowers can view their account balance at studentaid.gov.

However, if a borrower made payments throughout the pandemic and still owes $14,000, they will not receive an automatic refund. They can, however, request that $10,000 of that debt be forgiven.

“Borrowers who paid off their loans during the pause will need to request a refund first, then request cancellation,” said a spokesperson from the Department of Education.

The refund is not available for private student loans.

Eligible federal student loans:

- Direct Loans (defaulted and non-defaulted)

- Federal Family Education Loan (FFEL) Program loans held by ED (defaulted and non-defaulted)

- Federal Perkins Loans held by ED (defaulted and non-defaulted)

- Defaulted FFEL Program loans not held by ED

- Defaulted HEAL loans

If you are not sure which loan you have, visit your dashboard at studentaid.gov and find the “my loan servicers” section.

How can I apply for a refund?

Borrowers who want a specific amount refunded should contact their loan servicer. Refunds are currently only available by phone and not through a website or email.

Loan servicers were inundated with calls after the Biden Administration announced the forgiveness. However, many borrowers now say they don’t have to wait long when they call.

“I was on hold for about five minutes,” said Megan McParland, of New Jersey, who graduated in 2018 and made several payments during the payment freeze.

If you are not sure who services your loan, or if the servicer changed during the pandemic, visit your student aid account dashboard and scroll to “my loan servicers” or call 1-800-433-3243.

Loan servicers’ phone numbers:

- FedLoan Servicing: 1-800-699-2908

- Great Lakes Educational Loan Services, Inc.: 1-800-236-4300

- Edfinancial: 1-855-337-6884

- MOHELA: 1-888-866-4352

- Aidvantage: 1-800-722-1300

- Nelnet: 1-888-486-4722

- OSLA Servicing: 1-866-264-9762

- ECSI: 1-866-313-3797

- Default Resolution Group: 1-800-621-3115 (1-877-825-9923 for the deaf or hard of hearing)

How much can I get refunded?

According to the Department of Education, you can get a refund for the entire amount you paid during the payment freeze. You can, however, choose a lower amount.

When will I get my refund?

According to the Department of Education, borrowers should expect their refund six to twelve weeks after requesting it. However, you should double-check with your loan servicer.

Should I start paying again when the payment freeze ends?