Lifestyle

Car tax hike leaves high polluting vehicles costing thousands more to run

Drivers are being hit with shock bills of almost £5,500 a year just to get on the road after Labour and Rachel Reeves pushed through changes to car tax earlier this year. The Government has doubled first-year Vehicle Excise Duty (VED) charges for nearly all petrol and diesel models from April, making it far more expensive to run anything that isn’t electric.

The changes hit anyone with a petrol or diesel engine, but it’s those with the biggest polluting cars who are being stung the hardest. Just last year, someone buying a car that pumped out more than 255g/km of CO2 would have paid £2,745 in first-year VED. Now, that figure has almost doubled to £5,490, a huge jump that many households won’t be able to stomach, reported The Express.

Cars producing between 226 and 255g/km of CO2 now face a bill of £4,680, while those between 191 and 225g/km are charged £3,300. Even vehicles in the 171 to 190g/km band are slapped with £2,190 in their first year.

The move was first revealed in last year’s Autumn Budget and officially came into effect this spring. HM Revenue and Customs insists the plan is about making the gap bigger between drivers of petrol and diesel cars and those who choose zero-emission or hybrid vehicles.

A spokesperson said: “The government is committed to supporting the transition to electric vehicles. This change will increase the incentives towards new zero-emission cars at the point of purchase, and support take-up of new electric vehicles, which is crucial to achieving Net Zero. Revenue from this change will also help support public services and infrastructure across the UK.”

The Treasury reckons the updated charges will bring in an extra £45million in revenue between 2025 and 2026, though that figure is expected to fall away as more people move over to electric. By 2029 to 2030, the additional income is forecast to be around £200million.

Officials admitted the scheme will hit those buying brand new cars the hardest, especially wealthier drivers who are more likely to splash out on high-polluting models. But even with the focus on higher earners, the sheer scale of the increases has raised eyebrows among regular drivers who fear even mid-range petrol and diesel cars are becoming unaffordable.

HMRC also pointed out the policy applies to all new cars, including zero-emission vehicles, from April 2025 onwards. They added: “This measure will impact on motorists considering purchasing a new car from April 2025 onwards, including zero-emission cars.

The increase in Vehicle Excise Duty first-year rates may have more impact on people with higher incomes, as these individuals are expected to be more likely to purchase a new vehicle.”

For now, the changes look set to push more drivers towards electric options, but many will be weighing up whether the upfront savings are enough to justify the jump. For those sticking with traditional engines, though, the price of simply getting on the road has never looked steeper.

More News:

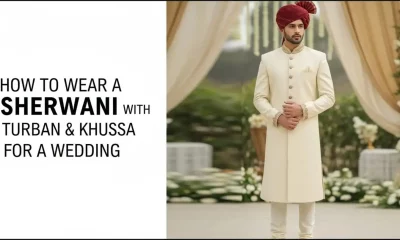

- How to Wear a Sherwani with Turban & Khussa for a Wedding

- “Happy Christmas to the Welsh Guards!” as Prince William shrugs off Prince Harry’s latest UK push

- Wedding Sherwani for Groom: Ideas for Nikkah, Baraat, & Special Events

- Crockett’s Bold Senate Campaign Video Draws Mixed Reactions Over Trump Attacks

- Ted Cruz Warns Trump’s Drone Plan Could Derail Major Defense Bill