More in Trends

-

Trends

Strut Your Stuff: The Ultimate Men’s Prom Suits

Hey fellas, so it’s that time of the year again – the season of corsages, slow...

-

Trends

The huge shark attacked an angler’s kayak off the coast of Oahu: WATCH

A Hawaiian angler escaped a horrifying encounter with a huge shark while fishing off the coast...

-

Trends

New COVID-19 variant Arcturus could grow in San Diego, experts say

Pink eye may be a sign of COVID-19. San Diego County public health experts say XBB.1.16,...

-

Trends

Senior software engineer dies after falling from the 14th floor of Google’s NYC headquarters

A 31-year-old senior software engineer died after falling from the 14th story of Google’s New York City...

-

Trends

The student uses Chat GPT to write a paper and gets a zero

With the advent of artificial intelligence (AI) and Chat GPT in a variety of areas, some...

-

Trends

YouTube star MrBeast pays to ‘cure’ 1,000 blind people: Here are 5 ways to save your health care costs if a celebrity hasn’t helped you yet

If you’re sick and don’t have a wealthy aunt or uncle to turn to, you may...

-

Trends

‘Masked Singer’ unveiling of Mantis absolutely stuns the judges

Jaws dropped and hands went up in the air after the reveal of Mantis on “The...

-

Trends

Hundreds of Tibetans rally in France in favor of the Dalai Lama amid a video controversy

Around 1,000-1,500 Tibetans gathered in front of the France Television office in Paris on Saturday to...

-

Trends

Single Tesla order from Elon Musk has increased a family’s fortune to more than $800 million

A single Tesla order boosted a family’s fortune by hundreds of millions of dollars. L&F, a...

-

Trends

A suspect detained in New York City smoke shop execution seen on video was out on bail for firing at officers

The suspect detained Tuesday was seen on a video wearing a jacket with the letters FDNY...

-

Trends

Texas parents claim CPS took their child after they used midwifery treatment for jaundice

Temecia and Rodney Jackson of Texas are requesting the return of their newborn baby, who was...

-

Trends

‘Walk to the light’: Woman’s final words to dying husband goes viral

On April 4, a video clip of the goodbye was released on Douyin, capturing the hearts...

-

Trends

Georgia woman risks her life and breaks both ankles to save 5-year-old granddaughter trapped in apartment fire

A grandmother’s brave acts saved the life of her 5-year-old granddaughter from an apartment fire in...

-

Trends

Scientists set a new mark for fish filmed in the deepest waters ever

Scientists have beaten the mark for the deepest fish ever recorded after capturing the so-called “snailfish”...

-

Trends

Emily Clarkson was praised for her inspirational post-birth body post: “This is NOT a bad thing”

Emily Clarkson has received praise for her sensitive post on postpartum bodies. The 28-year-old recently gave...

-

Trends

Pa. Mom Killed in Front of Son by Neighbors’ Great Danes She Was Watching: REPORTS

A Pennsylvania woman who promised to feed her neighbors’ Great Danes while they were out of...

-

Trends

Florida teacher’s assistant who was charged with taking a student’s Nintendo Switch was granted a protection order

On Thursday, a permanent order for protection was given to a Florida teacher’s assistant who was...

-

Trends

Sasha Walpole, the woman who claims to have Prince Harry’s virginity, is speaking out

Among the many OMGWTF revelations in Prince Harry’s book, Spare, the story about losing his virginity...

-

Trends

Cancer vaccinations already exist, but your doctor may not tell you about them until you ask

Cancer vaccines are a concept that appears to have been torn from the plot of a...

-

Trends

Second mountain lion dies near Los Angeles A month after the death of a famous cougar

Another mountain lion has died in Los Angeles, more than a month after P-22, a popular...

-

Trends

Danny Pintauro HIV+ actor blasts Candace Cameron Bure for her ‘horrifying’ interview

Danny Pintauro, an HIV-positive actor best known for his role on Who’s the Boss and in...

-

Trends

Fans refuse to accept Felicity Kendall’s real age as they remark on her appearance

Felicity Kendall’s real age had people floored On Wednesday night, BBC The One Show viewers were...

-

Trends

6-year-old who shot his teacher in Virginia by using his mother’s licensed gun

According to the Associated Press: Authorities said Monday that there was no quarrel, physical struggle, or warning in the seconds before a 6-year-old Virginia boy shot his teacher. “What we know today is that she was providing instruction. He displayed a firearm, he...

-

Trends

COVID autopsies reveal virus spread throughout the ‘entire body’

COVID-19 is classified as a respiratory infection, however, the new coronavirus’s effects are not limited to...

-

Trends

Kohberger spoke up in class, except when the topic was the Moscow killings

Bryan Kohberger’s graduate school friends remember him as an active member in his Washington State University...

-

Trends

Omicron Subvariant XBB 1.5: “The more this virus circulates, the more opportunities it has to mutate”

The novel Omicron sub-variant XBB.1.5 is causing concern in Asia and the United States, where it...

-

Trends

Miss Vietnam organizers forced to apologize for see-through gown: “It’s very unfortunate”

An angry audience criticized a beauty queen for wearing a “see-through” dress on stage. The organizers...

-

Trends

Mum finds ‘missing’ son in chimney after he went to find Santa: “His sister tried to follow him”

As if the holidays weren’t stressful enough for parents of small children, one mother got worried...

-

Trends

Teacher at Catholic school for deaf children put on leave after reportedly throwing a student: ‘Malicious act’

A teacher at an Ohio Catholic school for deaf children was suspended after being accused of...

-

Trends

How to determine the difference between Covid-19, influenza, respiratory viruses, and the common cold

As the festive season approaches and the brutal cold sets in, some people may find themselves...

-

Trends

Mother sparks serious debate as she slams mother-in-law for demanding ‘expenses’ while looking after grandson: “She refuses to use the train”

One mother was furious after her mother-in-law requested compensation for her travel expenses while caring for...

-

Trends

Inkar And Pininfarina Collaborate On Limited Edition iPhone Cases

The first collaboration is with the world’s most famous automotive design studio Pininfarina. Together, we created...

-

Trends

Gabby Petito’s parents win their second legal battle against Brian Laundrie’s family

Chris and Roberta Laundrie’s legal woes continue indefinitely. Brian Laundrie’s parents have recently lost another court...

-

Trends

Woman kidnapped as a child found 51 years later, reunited with family

A woman who was abducted as a child 51 years ago was recognized through DNA and...

-

Trends

Attorney Suffered Stroke And Missed Court, Clayton County Judge Scolded Him

An attorney who had a stroke and was unable to attend court is only speaking to...

-

Trends

Bride Surprises Groom at Their Wedding by Jokingly Blowing ‘Dust’ Off Her Vows

Byron and Christie Jefferies’ wedding was filled with humor, which the couple says is a key...

-

Trends

Four-year-old influencer films live streams, her mom takes her photos

A four-year-old has amassed over 42,000 subscribers on social media by hosting live streams and having...

-

Trends

Mom claims her 7-year-old daughter cyberbullied because of ‘Shark Tank’ appearance

A mother claims that after appearing on Shark Tank, she and her daughter were bullied. She...

-

Trends

COVID-19 shown to trigger inflammation in the brain: ‘A silent killer

COVID-19 activates the same inflammatory response in the brain as Parkinson’s disease, according to research led...

-

Trends

Heartbroken: Jelena Dokic reveals ‘sick’ video of tennis dad beating daughter

The tennis community has condemned the actions of a Serbian father after a video of the...

-

Trends

‘Good Witch’ fans Just Got a Heart-Pumping Update About a Possible Season 8

Catherine Bell and James Denton might be back after all. The Hallmark Channel original series, starring...

-

Trends

Stepfather brutally Kills Father of Sisters in Wisconsin

Six people, including 12-year-old Sofina and 14-year-old Natalie Kleemeier, were found dead in an apartment in...

-

Trends

Marietta Police Department expanding its mental health relaxation room

When firefighters and police officers respond to calls, some of the situations they encounter are more...

-

Trends

Researchers develop a new strain of Covid-19 in a laboratory with an 80% kill rate: REPORTS

A team of researchers at the prestigious university developed a hybrid strain by combining the Omicron...

-

Trends

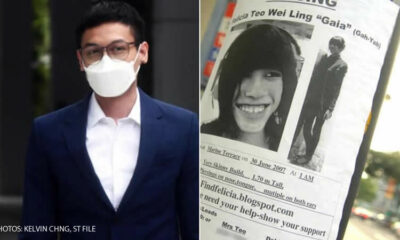

The Felicia Teo case: Man admits to dumping a dead body, sentenced to 26 months in prison

It’s difficult to believe that this case has been ongoing for more than a decade. What...

-

Trends

Ex-Teacher Faces Murder Trial After Family of 3 Are Shot to death in California

Dana Rivers has been charged with three counts of murder, arson, and other charges Six years...

-

Trends

Biden student loan relief application will be available soon: Here are 5 steps to prepare

Millions of borrowers will be asked to submit an application to be approved for President Biden’s offer...

-

Trends

Elon Musk shows a robot that can “raise the roof” And that’s about it for now

Elon Musk wants self-driving autonomous to take over factory jobs currently held by humans. But on...

-

Trends

L.A. Volunteer criticized conditions at the animal shelter and says she was fired

A volunteer who criticized the city of Los Angeles’ care of rabbits and other small mammals...

-

Trends

Australian surfer Chris Davidson killed after One-punch outside a pub

Chris Davidson, a legendary former pro surfer, is believed to have been killed in a country...

-

Trends

Burger King Employee criticizes customer who complained uniform was ‘a distraction’

A Burger King employee posted a frustrated TikTok after a customer allegedly told her that her...

-

Trends

TikTok Users Adore the Trending “Sticky Method” for Covering Acne and Dark Spots

Another day, another TikTok viral trend to explore. The “sticky method,” which is supposed to ensure...

-

Trends

Life after monkeypox: Men describe the road to recovery

During the four months of the monkeypox outbreak, health care providers, researchers, and a worried public...

-

Trends

People have been hospitalized after the TikTok chip challenge: ‘I couldn’t breathe

People are being admitted to hospitals for treatment as a result of a new viral food...

-

Trends

Georgia’s mom texted before she was found dead: ‘They won’t let me go

Deborrah Collier’s partly burned naked body was found in the woods near a Georgia state road...

-

Trends

Boy Gives Heartbreaking Testimony at Trial of Father Convicted of Murdering His Mother

After his son testified against him, Amos Jacob “A.J.” Arroyo, 36, was convicted of two counts...

-

Trends

Biden agrees with your boss that it’s time to move on from COVID: ‘The pandemic is over

In an interview with CBS News aired Sunday evening, US President Joe Biden declared the COVID...

-

Trends

Brooklyn’s mother was held in custody for drowning her children and released from the child welfare system without psychiatric examination

Merdy, 30, suffered from depression, post-partum precisely, but was not properly evaluated Erin Merdy, who drowned...

-

Trends

Mum & stepdad left their 5-year-old daughter in the cold bath as “tortuous punishment for misbehavior,” leaving her “just minutes from death”

Her condition was ‘more consistent with someone who had fallen into the North Sea – she’s...

-

Trends

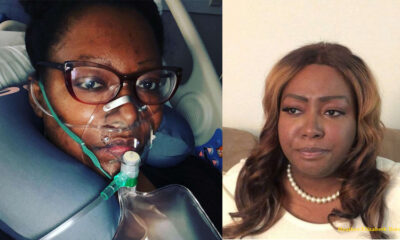

Mom Forced to Choose Between Cancer Treatments and Childbirth Makes Her Decision

After losing both his love and his newborn son within months of each other, the man...

-

Trends

Texas man marries his fiancé as doctors told he has only one day to live

Thanks to some quick planning, the staff at Baylor St. Luke’s Medical Center helped fulfill Noah...

-

Trends

Pit Bull Grabs Baby And Drags Her Outside

Nana Chaichanhda kept chanting the same thing over and over again: “I owe Sasha my life.”...

-

Trends

The 3-year-old girl declared ‘dead,’ wakes up at her funeral, then dies again

After doctors mistakenly assumed she was dead the first time, a 3-year-old girl woke up during...

-

Trends

2-Year-Old Boy Dies After Swallowing On Common Fruit

Any parent’s worst nightmare is to overlook the child they brought into the world. This is...

-

Trends

Missing Girl Found after Nine years Recalls Horrific Experience

Pooja Gaud, 16, is finally able to rest her head on her mother’s lap after nine...

-

Trends

A Christian school in Florida forced gay, transgender, and nonbinary students to ‘leave the school immediately

Parents were informed by a Christian school in Florida that gay, transgender, and nonbinary students “will...

-

Trends

Russian missile strikes Mykolaiv residential building: Crimea hit again

(UPI): A Russian missile strike hit a residential building in Mykolaiv on Saturday morning, injuring several...

-

Trends

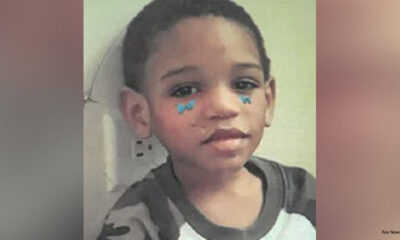

Damari Perry case: Mother And Brother Face New Charges In ‘Brutal And Heinous’ Death

Damari Perry’s mother and adult brother are facing new charges in the 6-year-old’s brutal 2021 murder. As...

-

Trends

FBI Locates 121 Adolescent Victims, 141 Adult Victims in Nationwide S*x Trafficking Operation

Justice Department, FBI announces results of ‘Operation Cross Country. 84 minor victims of child s*x trafficking...

-

Trends

A neighbor found a 2-Year-Old Girl Who Went Missing For Days Guarded By a Pit Bull

A missing child is every parent’s worst nightmare. They can’t help but wonder what has happened...

-

Trends

Viral Video: Crocodile Drags Man Deep Into Water after Killing Him in India

A crocodile killed a man after he fell into a river in the western Indian state...

-

Trends

Scientists Found an Ancient Jellyfish That Lived 557 Million Years Ago

Auroralumina attenboroughii was an ancient animal that lived between 557 million and 562 million years ago....

-

Trends

Study finds Connection of Diseases with Climate

According to a study, more than half of the hundreds of human diseases, including malaria, hantavirus,...

-

Trends

Young Mom Is Deadly Shot in head While Picking Up Son from Babysitter

Beverly Lambert was shot and killed in Morris, Ill. on Aug. 4 A young mother from...

-

Trends

The study challenges the belief that women survive longer than men

Researchers said that just looking at life expectancy could lead to ‘distorted perceptions The long-held belief that...

-

Trends

Brazilian Twins Who Were Joined at the Head Successfully Separated with the Help of Virtual Reality

Three-year-olds Bernardo and Arthur Lima underwent surgeries in Rio de Janeiro, with direction from Great Ormond...

-

Trends

Australian Scientists Demonstrate New Way to Restore Insulin Production in Pancreatic Cells Using Already Approved Drug

Australian scientists have developed a new method for restoring insulin production in pancreatic cells, using a...

-

Trends

Newborn started having seizures and was placed on a ventilator before he died at just 34 days old after contracting a virus: “This virus stole my son from me”

The baby’s parents became aware of a problem a week after the baby was born. The...

-

Trends

Cancer drug found to regenerate a damaged spine: “This is an exciting time”

AZD1390 is under investigation by AstraZeneca, which helped develop a Covid-19 vaccine that has seen more...

-

Trends

Husband wakes up with large red stripes all over his back in a tourist spot – wife realizes their big mistake

The majority of vacationers will receive a massage. This is particularly true in countries like Thailand...

-

Trends

Majority of Americans Say Their Condition got Worse Today than a Year Ago: New Survey

More than half of Americans say they are financially worse off than they were a year...

-

Trends

Kaitlin Armstrong, the Accused Killer, May Have Undergone Cosmetic Surgery: ‘Whoa, what happened to you?’

After being arrested in Costa Rica the previous week, yoga instructor Kaitlin Armstrong, who was charged...

-

Trends

Therapy Puppy at N.B. Fire Department Dies in his Sleep: He touched the hearts of many

A beloved Labrador puppy belonging to the fire department in New Brunswick has passed away. The...

-

Trends

Scientists Solve Seven Century-Old Mystery as DNA from Ancient Grave Reveals Black Death’s Patient Zero

A Knight’s Tale is a classic story of mediaeval adventure that follows William Thatcher (Heath Ledger)...

-

Trends

Police Find No Evidence 6-Year-Old Was Burned Deliberately Mother of Cleared Boy Speaks Out

“How can you do this to my child and my family?” Laura Giacobbe said. After an...

-

Trends

Can Another Stimulus Check Fix The Soaring Inflation Rate?

The US government has spent $6 trillion on Covid-19 relief, with around $850 billion going to...

-

Trends

Angry Hull man beat puppy unconscious and threatened to ‘kill it’ after it peed on him

Jake Atkin has been told he will not be able to own or look after any...

-

Trends

Six People Charged In Cleveland for Torture-Killing Of Woman: A Revenge For Previous Killing

The group was indicted for aggravated murder and conspiracy. Six persons have been charged with aggravated...

-

Trends

A cancer-killing virus was injected into humans for the first time to improve outcomes for patients in their battle with cancer

City of Hope and Imugene Limited, a clinical-stage immuno-oncology company, reported today that the first patient...

-

Trends

‘This Video Will Change You’: People in Tears over Urgent Plea for Gun Sanity after yet another Mass Shooting at American School

After yet another school massacre in the United States, a new video makes a simple request....

-

Trends

Ohio Grandparents Arrested In ‘Unimaginable’ Cruel Child Abuse Case That Police Say ‘Makes You Sick’: ‘If there’s A Victim of This Type of Abuse, It’s Tragic’

A couple of Ohio grandparents have been arrested for allegedly participating in severe punishments that their daughter...

-

Trends

$10 Million Lottery Winner Sentenced To Prison after Being Found Guilty Of First-Degree Murder in Fatal Shooting of His Girlfriend

A man who won $10 million in the lottery in 2017 was sentenced to life in...

-

Trends

9-Year-Old Girl Miraculously Escaped, Conscious in ICU and ‘Fully Alert’ After Being Threatened By Cougar Attack

After being threatened by a cougar during a Memorial Day Weekend camping trip in northwest Washington,...

-

Trends

A woman who took a selfie in Andy Carroll’s bed begs forgiveness from his fiancée Billi: ‘I’m so sorry for all this mess”

The woman who was pictured sleeping in bed next to English footballer Andy Carroll on his...

-

Trends

COVID Cases Are Six Times Higher Than This Time Last Year: “I don’t think it’s done with us”

Regardless of what the calendar says, the Memorial Day holiday weekend has always been America’s unofficial...

-

Trends

‘Top Gun: Maverick’ wins Tom Cruise’s first $100 million opening

Forget breaking the sound barrier: Tom Cruise has just passed an important career milestone. With “Top...

-

Trends

Taking this medication for even a short period of time increases dementia risk

MULTIPLE STUDIES HAVE LINKED THESE MEDS TO DEMENTIA, ACCORDING TO A NEW REPORT. A number of...

-

Trends

The woman remained on a ventilator for 31 days after catching COVID-19 and manages health conditions she didn’t have before contracting the virus

The 37-year-old woman claims she now has diabetes and high blood pressure, which she did not...

-

Trends

Father Of 33 Kids Claps Back At Social Media Calling Him ‘Irresponsible And Nasty’ After Family Picture Goes Viral

Demond George, a father of 33 children, recently uploaded a family photo on Facebook, which soon...

-

Trends

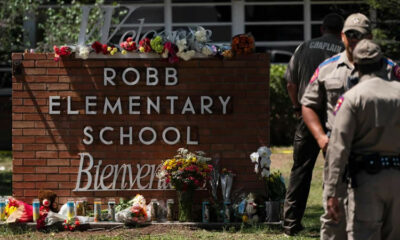

A Psychologist from Central New York and mass Shooting Expert Weigh in on Texas School Shooting

Authorities say 19 students and two adults were killed in a shooting at a Texas elementary...

-

Celebrities

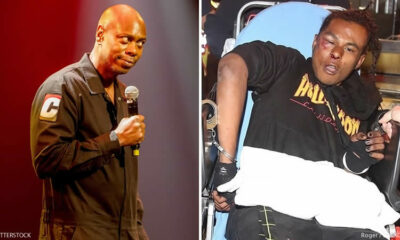

Dave Chappelle’s Attacker Reveals Details Why He Tackled The Comedian: ‘It’s Not A Joke’

Isaiah Lee, the 23-year-old guy who attacked comedian Dave Chappelle during his performance, has spoken out...

-

Trends

Chinese brothers use a hand Cart to Pull their Sick Mother from the Hospital 22 Miles to their Home

Two Chinese brothers showcased their unconditional love for their mother by traveling 22.37 miles with a...

-

Trends

A female teacher in California was arrested after ‘teaching a class while drunk and prescribed medications’

The high school teacher was placed on administrative leave after she was reportedly teaching her students...

-

Trends

North Carolina Woman Wrote a Book detailing the aftermath of car Accident that Killed her husband and Son

North Carolina woman has penned a book detailing the aftermath of a car accident that killed...

-

Trends

COVID-ill Mother, who doesn’t Remember giving Birth after a Long Battle with the virus that nearly took her life, is reunited with her baby

COVID-ill mother, who doesn’t remember giving birth after a long battle: “It’s miraculous except its actually...

-

Trends

North Charleston police looking for a patient who ran away from Palmetto Behavioral Health

North Charleston Police looking for a patient who allegedly left a mental health hospital last week...

-

Trends

It’s Your Last Chance To Get It With The Third Stimulus Check

It’s not too late to apply for a third stimulus check worth up to $1,400 per...

-

Trends

School Athletic Director lost his job after the school district put him on Administrative leave for Sending an unsuitable text message to a Student

The high school athletic director off-track his job after the school district put him on administrative...

-

Trends

An elderly Sikh Man Visiting NYC Attacked in Possible Hate Crime

A 70 years old Sikh man coming from India was attacked mercilessly, his face and clothes...

-

Trends

Huge Rare Snake Found in California’s Man’s Couch

A 7-feet-long Vietnamese blue beauty rat snake discovered by the California man curled up on his...

-

Trends

North Carolina Gay Couple Adopts Dog Abandoned for Being Gay

When Steve Nichols and his partner, John Winn, learned of Fezco’s suffering after he humped a...

-

Trends

NYC Woman Allegedly Dismembered by Serial Killer and Died From Blunt Force Trauma to Head, Medical Examiner Says

According to the city’s Medical Examiner’s office, the woman who was reportedly murdered and then dismembered...

-

Trends

Gabby Petito’s Family in Contact with Politicians… To Locate Missing People

Gabby Petito’s parents are working with senators and governors to develop a nationwide missing person’s database...

-

Trends

A newly released Video Shows a California man Screaming, “I can’t breathe!” Before Dying in Police Custody

A Southern California man died nearly two years ago as he shouted “I can’t breathe” while...

-

Trends

The student threw a Chair at a Substitute teacher in Texas, he was Left with Bleeding Face: Watch Video

According to frightening footage, a student at a Texas middle school threw chairs at a 73-year-old...

-

Trends

Broadway Singing Coach in Critical Condition after NYC Sidewalk Attack, New York Police Department Looking For Suspect

Police in New York City is looking for a woman who shoved a renowned 87-year-old singing...

-

Trends

Two Ukrainian Surrogacy Babies Born to American Couple

After a long journey to Ukraine, an American couple can finally breathe a sigh of relief....

-

Trends

How to Encourage your Children to follow their Interests without being Pushy

When a child develops an interest, it’s natural for parents to want to see them succeed....

-

Trends

Ukrainian Minister says World’s Largest Cargo Plane was Destroyed during a Russian Airfield Attack

According to Ukraine’s foreign minister, Dmytro Kuleba, the world’s largest cargo plane, the An-225 Mriya, was...

-

Trends

On the premiere of ‘AGT: Extreme,’ wheelchair daredevil had a Scary Wipeout

When 29-year-old wheelchair daredevil Aaron Wheelz had a horrific wipeout on America’s Got Talent: Extreme, the...

-

Trends

Watch: Yemeni Man Breaks His Own Guinness Record By Stacking Four Eggs On Top Of One Another

The most challenging part of the attempt, according to the record holder, was determining the center...

-

Trends

Should Parents Take Cell Phones Away from Their Children? 4 Things to Think About

I took away my son’s phone a few weeks ago after he failed to complete a...

-

Trends

Woman Dies While Performing Motorbike Stunts on Rooftop of Shopping Mall in California

After slipping on the handlebars of her motorbike while performing stunts, a young woman died on...

-

Trends

Imogen Tothill: Body Found In Wooded Area By Police Searching For Missing 17-Year-Old Girl

Although the human remains have not been formally identified, they are thought to be those of...

-

Trends

Mother warns other Parents after her 2-year-old Daughter becomes Paralyzed after Injuring herself during a Home Playtime

The 2-year-old girl was playing on her playmat when she fell and injured herself. According to...

-

Trends

Footage of Drag Race between Tesla’s Model S Plaid and Lucid Air

Now that the Lucid Air is a practical reality, one question remains: how does it compare...

-

Trends

Mother Forced Her 11-Year-Old Daughter to Live In Apartment with Decomposing Body of Girls’ Father for Several Weeks and Use Bucket as Toilet

According to court documents, the mother was arrested on Tuesday after she allegedly forced her daughter...

-

Trends

Scientists believe they have Figured out when the Sun will Erupt and Kill us All

Our Sun is not as old as other stars in the universe. However, scientists are already...

-

Trends

Investigators Reveal a Shocking Twist, After a Teen’s Burger King drive-thru Slaying

The horrific news that a 16-year-old girl was shot and killed while working at a Burger...

-

Trends

In the 2019 disappearance of a New Hampshire girl, the father was arrested

The father of a New Hampshire girl who hasn’t been seen since 2019, but whose absence...

-

Trends

Little girl begs her mother to let her shop online so she can sign with her favorite delivery driver: ‘The world needs love like this’

A sweet relationship between a girl and her favorite delivery driver is touching people’s hearts all...

-

Trends

Stimulus Check Update: No Joy In New Year

For a long time, people have speculated about Stimulus Check four. The earlier checks gave the...

-

Trends

Fauci Attempts to Clean up Kamala Harris’s COVID Mess, but it’s Not Working

Kamala Harris said something about COVID yesterday that was pretty hard to believe. The scientists “upon whose advice...

-

Trends

CDC recommends social distance from pets to Avoid Omicron Spread

“If you wouldn’t go near another person because you’re sick or you might be exposed, don’t...

-

Celebrities

TikTok videos of Hospice Nurse went Viral: Make Death a Little Less Scary

It is difficult, confusing, terrifying, and heartbreaking to witness the death of a loved one. They...

-

Trends

5 Ways to Get Thicker, Fuller Hair

First things first: It’s nearly impossible to thicken your hair Opens a New Window.at the root itself unless...