Politics

What’s Behind the Push for a Fourth Stimulus Payment

The IRS distributed more than 169 million payments in the third round of direct stimulus aid, with more than 2 million recipients receiving $1,400 checks in July. However, some senators are advocating for the fourth round of economic aid, which would essentially send recurring payments until the pandemic is over.

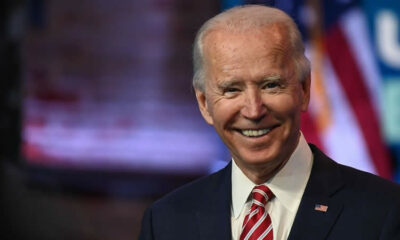

As of now, the government response to the economic crisis caused by the coronavirus pandemic has paid out $3,200 to eligible adults: $1,200 under the Coronavirus Aid Relief and Economic Security Act, signed into law in March 2020; $600 in a December relief measure; and $1,400 under President Joe Biden’s American Rescue Plan, signed a bill in March.

Despite this aid, millions of Americans are still in financial trouble, and the spread of the Delta variant is generating new economic obstacles. According to recent Census survey data from the last two weeks of August, nearly one-quarter of Americans struggled to pay their household bills in the last week of August.

The unemployment rate stands at 5.2%, which is still higher than the pre-pandemic figure of 3.5%. Even though businesses are hiring, there are still approximately 5.3 million fewer individuals on payrolls today than there were before the pandemic. Economists are concerned about the spread of the Delta variety, with Oxford Economics recently lowering its prediction for global economic growth in 2021 to 5.9% from 6.4%.

“Uncertainty and hesitancy may ultimately lead to a more slow-burning recovery from here than our baseline assumes,” wrote Ben May, director of global macro research at Oxford Economics, in the report.

Consequently, 9.1 million Americans lost enhanced unemployment benefits on Labor Day, when the federal payments expired. This will result in the loss of around $5 billion in weekly benefits that had been provided to unemployed people – aid that had assisted those individuals in paying for groceries, rent, and other essentials.

In short, the newest batch of $1,400 checks is long gone for many people, even while another pandemic support is winding down – an issue on the minds of many Americans who continue to battle with joblessness and a poor labor market. Indeed, over 2.8 million people have signed a Change.org petition that was launched last year, urging politicians to pass laws requiring recurring $2,000 monthly contributions.

Some legislators have taken up the concept. Twenty-one senators, all Democrats, signed a March 30 letter to President Joe Biden in support of periodic stimulus payments, pointing out that the $1,400 payment issued by the IRS won’t last long.

“Almost 6 in 10 people say the $1,400 payments set to be included in the rescue package will last them less than three months,” the senators wrote in the letter.

Meanwhile, several states are creating their own form of stimulus checks. Approximately two-thirds of California residents are anticipated to be eligible for a “Golden State Stimulus” check as a result of Governor Gavin Newsom’s new initiative. This initiative will pay $600 to low- and middle-income residents who have already submitted their 2020 tax forms. Teachers in Florida and parts of Texas have been given bonuses to help offset the effects of the outbreak.

The senators’ letter does not specify the size of the payments they are seeking, but a separate campaign by Democratic lawmakers in January pushed for $2,000 monthly compensation until the pandemic is over. The American Rescue Plan, on the other hand, permitted $1,400 for each suitable adult and dependent.

Child Tax Credit

On July 15, the IRS deposited the first of six monthly cash payments into the bank accounts of parents who qualify for the Child Tax Credit, providing assistance to certain families (CTC). According to a left-leaning advocacy group’s study of Census data, families received an average of $423 in their first CTC payment.

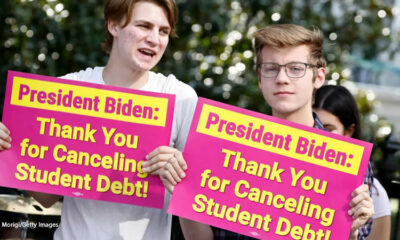

Eligible families will receive up to $1,800 in cash through December, with the funds distributed in equal payments over a six-month period beginning in July and ending in December. The assistance is provided as a result of the expanded CTC, which is part of President Joe Biden’s American Rescue Plan.

Families who qualify will get $300 every month for each kid under the age of six, and $250 for children aged six to seventeen. Several families who spoke with CBS MoneyWatch said the extra cash would be used for child care, back-to-school supplies, and other necessities.

If Mr. Biden’s American Families Plan is implemented, families may benefit from additional tax breaks in the future years. The Child Tax Credit would be expanded through 2025 under that plan, giving families an additional four years of larger tax relief for children.

Emergency funds

According to a recent Federal Reserve Bank of New York analysis, respondents who have received the three rounds of stimulus payments have reported they are utilizing the majority of the monies to pay down debt or save. This could imply that people are utilizing the money to pay off debts accrued during the pandemic as well as to save for an emergency in case of another shock.

Bankrate.com said in April that nearly 7 in 10 Americans who have received, or anticipate they will soon receive, a third payment consider it vital for their short-term finances. This is really down from about 8 in 10 people in March 2020, when the outbreak caused widespread unemployment, but the total share of people in need of further help remains elevated more than a year later, according to the personal finance firm.

According to the survey, over 1/3 of those surveyed thought the stimulus aid would help them for less than a month.

Scientists found that the three waves of stimulus funds saved millions of Americans from hardship. However, when the stimulus has failed, such as last fall when Congress was unable to agree on another round of help, suffering has increased “markedly” in November and December, according to a May analysis of data from the University of Michigan.

Still surviving paycheck to paycheck

Some of the world’s leading economists have pushed for more direct assistance to Americans. Last year, more than 150 economists, including former Obama administration economist Jason Furman, signed a letter advocating for “recurring direct stimulus payments that last until the economy recovers.”

Although the economy is improving, millions of individuals continue to suffer from low income and are unable to access government assistance programs, according to Nasif. According to a March study by economist Eliza Forsythe, only 4 in 10 jobless people received unemployment benefits.

“You’ll see reports about how the economy is starting to grow, but there are a lot of Americans living paycheck to paycheck, and for a lot of them the government relief programs haven’t been able to help,” said Greg Nasif, political director of Humanity Forward.

How likely is a fourth stimulus check?

According to Wall Street analysts, don’t hold your breath. Raymond James analyst Ed Mills told CNBC, “I think it’s unlikely at this time.” One reason for this is because the Biden administration is focused on moving through with its infrastructure plan, which would change the economy by repairing outdated schools, roads, and airports, as well as investing in projects ranging from affordable housing to the internet.

According to Stifel’s Brian Gardner in an August 11 research note, the proposal, which the White House says would be funded by increasing the corporate tax rate from 21% to 28%, will likely consume Congress this fall.

“The fall is shaping up to be a busy time in Washington as Congress tries to finish two infrastructure bills (one which includes tax hikes), approve the annual spending bills, and raise the debt ceiling,” he noted.

Delta headwinds?

At the same time, the economic recovery is being hampered as the Delta variety expands across the country. Some states with low vaccination rates are seeing an increase in COVID-19 cases, which may discourage people from working in restaurants or other industries that expose them to the public.

According to a recent study, Texas’ failure to curb the COVID-19 increase in the state has resulted in nearly 72,000 job losses and an annual decrease in output of more than $13 billion. Fear of getting COVID-19 is also linked to employment losses in Texas, as workers choose to stay at home or are required to stay at home to care for sick family members, according to the study.

“This cliff threatens the economic recovery progress we have made by draining the economy of consumer spending and will put millions of workers at risk of lasting hardship,” said Century Foundation senior fellow Andrew Stettner in a statement.

cbsnews’ Aimee Picchi contributed to this report.